by WorldTribune Staff, November 18, 2025 Real World News

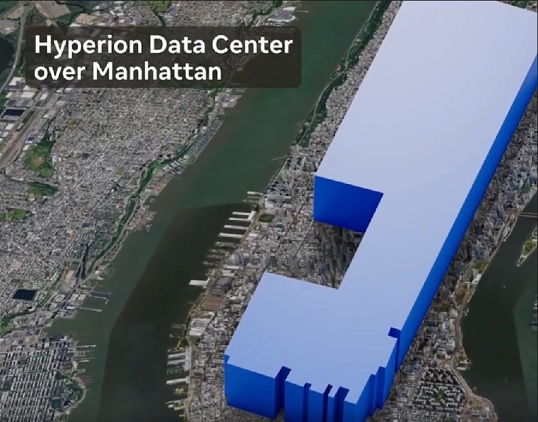

When completed, Meta’s AI data center in Louisiana will be larger than the area of Midtown Manhattan.

The multi-billion dollar Hyperion project, being developed in partnership with investment firm Blue Owl Capital, will also require new gas-fired power plants to meet its enormous energy demands.

Massive, anonymous data buildings are popping up in cities nationwide.

Massive, anonymous data buildings are popping up in cities nationwide.

With many such projects in the works throughout the U.S., will the financial world get skittish? Is the AI boom too big, too fast?

Big Tech companies are expected to pour nearly $3 trillion into AI through 2028 but only generate enough cash to cover half that tab, according to analysts at Morgan Stanley.

“Big names in the financial world, such as Goldman Sachs CEO David Solomon, are warning about AI-fueled froth in the markets and in capital spending,” the Wall Street Journal noted in a Nov. 16 analysis.

“At the same time, the fear of missing out is real. Days after Solomon voiced his concerns to analysts, Goldman formed a new team in its banking and markets group focused on AI infrastructure financing.”

A new survey found that 45% of fund managers see an AI bubble as the top “tail risk” for markets, and a surge of concern that companies are overspending, chiefly on AI-related projects.

“What we do know for certain is that the [Big Tech companies] that want the world to spend trillions have huge financial incentives to be believers. In case you haven’t noticed, Wall Street is also being paid a lot to promote the story,” Greenlight Capital, the hedge-fund firm run by David Einhorn, wrote in an October letter to investors.

The Journal’s analysis noted: “If the AI market blows up, the blast radius would be wide, hitting not only Wall Street firms, but also pensions, mutual and exchange-traded funds and individual investors, because of how debt is often sliced and resold across the financial landscape.”

Blue Owl Capital is certainly riding the wave of the AI boom. Only recently, the firm was lending money to midsize U.S. companies such as Sara Lee Frozen Bakery. Now, Blue Owl is financing massive AI data centers costing tens of billions of dollars for the likes of Meta and Oracle.

“We’re talking about numbers that are so large, even in the low cases,” said Blue Owl co-founder Marc Lipschultz. “Does it even matter if you keep counting after you get to $1 trillion of capital expenditure in the next couple of years?”

There have been warning signs, last week’s selloff in tech-related stocks and bonds being one of them.

Some analysts say the rapidly expanding AI industry demands far more electricity than the grid can provide.

AI data centers in the U.S. will require about 69 gigawatts of power between 2025 and 2028, an amount comparable to the total consumption of an entire industrialized nation, Cryptodnes reported.

Nvidia estimates that building just 1 gigawatt of AI data-center capacity can cost $50-$60 billion.

Closing the gigawatt gap would require around $2.6 trillion in power-related investment alone, as per the Cryptodnes report. That figure doesn’t include the additional $2 trillion needed to construct the data centers themselves.

“But any worries on Wall Street about a possible investment bubble have largely been trumped by the fear of being left behind,” the Journal’s analysis said.

“Silicon Valley’s biggest players are flush with cash and were able to fund much of the initial AI build-out from their own coffers. As the dollar figures climb ever higher, they are turning to debt and private equity — spreading the risks and potential rewards more broadly across the economy.”

Some of the financing is coming from plain-vanilla corporate bond sales, but financiers are making far bigger fees off giant private deals.

“Virtually every Wall Street player is angling to get a piece of the action, from banks such as JPMorgan Chase and Morgan Stanley to traditional asset managers such as BlackRock,” according to the Journal’s analysis.